How to survive recession

20 Jan 09, 01:10pm

20 Jan 09, 01:10pm

âWhile everyone was enjoying the sunny bright sky, it has suddenly become cloudy and dim.â

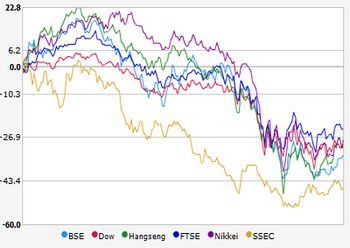

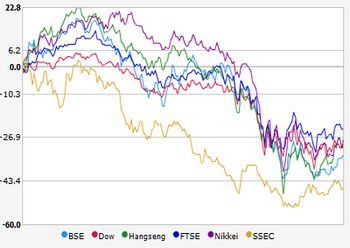

Thatâs what recession has brought in the minds of people. Prosperous job opportunity can be found nowhere. Loans were not readily available. People are getting fired. Sensex plummeted down. Corporates are revealing there fraudulent face. Real estate prices came down. Companies are cutting cost, even avoiding snacks and tea to their visitors. Employee satisfaction was put to shelf.

Many people are comparing this recession with that of 1930s. We can choose to sit around and blame the banks and the Government but complaining will not make one bit of difference.

While we do not know how long it will be, we know that it has the potential to be the worst financial crisis any of us have lived through. There are certain precautions that can be taken before the financial storm.

Donât Panic : You are here because you are fearful. Donât get panicked. Recession which started in US, is slowly gripping India. As this is just the beginning stage in our country, it can be corrected to a big extend by taking some precautions. Know you have got some time. So be fearless and start preparing.

Recession starts in the mind Having an understanding of behavioral pattern of people will be enough to give you the edge that you need to remain financially secure during recession. Know that the economy will be fine in the long run, and that huge declines in stock prices are only temporary. Itâs the law of the financial god that, every boom is followed by a recession. There is no other way than to face it.

This recession may be small. The recent recessions of 2001 and 1990 survived only for less than a year. Letâs be optimistic while we prepare for the worst as there are no silver bullets that can insulate us from any financial crisis.

Use credit card to a minimum as they are charging high interest rates. Compulsive buyers buy with cards and later find no money to pay. So itâs better to stay away from cards.

Help our country to benefit from your living, if you have a choice to buy an Indian product, buy it. Avoid monopolistic companies. Know that there is no Indian cola.

Income may come from different sources. If your primary source of income is from your job, protect it.

Upgrade your skill sets, be more dedicated and spend extra time at office.

Have a plan B if you lose your job. Always be knowledgeable about new opportunities also update your resume regularly. Look out for a second income. Live within your means. Used appliances and goods will be available cheap, as there are lots of sellers.

Evaluate your loan. Refinance for better offers. If you have good payment history banks are still there with open hands. Reduce your spending.

Make an emergency fund. Financial planners agree that an emergency fund should be equal to at least six-month worth of living expenses All investment you have is at risk so diversify the investments, diversify risk and donât stop savings.

Profiting : People who have earned well and saved enough, itâs their time again, they can buy asset dirt cheap. Recessions may very well be the greatest investment opportunities of a person's lifetime. Investing in real estate is one of the best ways that you can make money.

Food, healthcare, repair services are some of the businesses which will go up or stay unaffected during recession. Agriculture is relatively safe and secure compared to so many other businesses. At least raise some vegetables in your backyard. Itâs good for earth, your pocket, and your health.

Be smart enough to take advantage of the situation. Any way that piece was not for my brothers who were not having good time during the boom.

âThe greater the contraction, the greater the reboundâ is the principle.

I am summing up this article with my friendâs comment âActually, I have always been in a recessionâ.

Thanseer M.A

Thatâs what recession has brought in the minds of people. Prosperous job opportunity can be found nowhere. Loans were not readily available. People are getting fired. Sensex plummeted down. Corporates are revealing there fraudulent face. Real estate prices came down. Companies are cutting cost, even avoiding snacks and tea to their visitors. Employee satisfaction was put to shelf.

Many people are comparing this recession with that of 1930s. We can choose to sit around and blame the banks and the Government but complaining will not make one bit of difference.

While we do not know how long it will be, we know that it has the potential to be the worst financial crisis any of us have lived through. There are certain precautions that can be taken before the financial storm.

Donât Panic : You are here because you are fearful. Donât get panicked. Recession which started in US, is slowly gripping India. As this is just the beginning stage in our country, it can be corrected to a big extend by taking some precautions. Know you have got some time. So be fearless and start preparing.

Recession starts in the mind Having an understanding of behavioral pattern of people will be enough to give you the edge that you need to remain financially secure during recession. Know that the economy will be fine in the long run, and that huge declines in stock prices are only temporary. Itâs the law of the financial god that, every boom is followed by a recession. There is no other way than to face it.

This recession may be small. The recent recessions of 2001 and 1990 survived only for less than a year. Letâs be optimistic while we prepare for the worst as there are no silver bullets that can insulate us from any financial crisis.

Use credit card to a minimum as they are charging high interest rates. Compulsive buyers buy with cards and later find no money to pay. So itâs better to stay away from cards.

Help our country to benefit from your living, if you have a choice to buy an Indian product, buy it. Avoid monopolistic companies. Know that there is no Indian cola.

Income may come from different sources. If your primary source of income is from your job, protect it.

Upgrade your skill sets, be more dedicated and spend extra time at office.

Have a plan B if you lose your job. Always be knowledgeable about new opportunities also update your resume regularly. Look out for a second income. Live within your means. Used appliances and goods will be available cheap, as there are lots of sellers.

Evaluate your loan. Refinance for better offers. If you have good payment history banks are still there with open hands. Reduce your spending.

Make an emergency fund. Financial planners agree that an emergency fund should be equal to at least six-month worth of living expenses All investment you have is at risk so diversify the investments, diversify risk and donât stop savings.

Profiting : People who have earned well and saved enough, itâs their time again, they can buy asset dirt cheap. Recessions may very well be the greatest investment opportunities of a person's lifetime. Investing in real estate is one of the best ways that you can make money.

Food, healthcare, repair services are some of the businesses which will go up or stay unaffected during recession. Agriculture is relatively safe and secure compared to so many other businesses. At least raise some vegetables in your backyard. Itâs good for earth, your pocket, and your health.

Be smart enough to take advantage of the situation. Any way that piece was not for my brothers who were not having good time during the boom.

âThe greater the contraction, the greater the reboundâ is the principle.

I am summing up this article with my friendâs comment âActually, I have always been in a recessionâ.

Thanseer M.A

Amaran

Amaran Brother

Brother Lucky Baskhar

Lucky Baskhar Vettaiyan

Vettaiyan Meiyazhagan

Meiyazhagan Thangalaan

Thangalaan The Greatest Of All Time

The Greatest Of All Time Mazhai Pidikkatha Manithan

Mazhai Pidikkatha Manithan